Where to for the property

market in 2021!

|

SQM Research is the latest to do an about face on previous doomsday forecasts, now predicting a rebound for 2021 that is closer to what we predicted in September, of 10% growth over the next year. SQM are notable for making accurate predictions over the longer term and we have great respect for Louis Christopher and his team. However, SQM did make a rare mistake predicting in April a decline of up to 30%, thus proving even the best are fallible. Their predictions for 2021 still look slightly conservative to us.

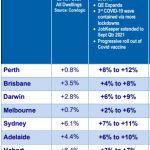

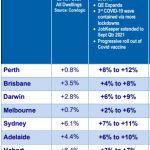

Key points from SQM’s base case predictions:

- All capital citiesto rise in 2021.

- Perthis the front runner, with 12% predicted growth. Every man and his dog has jumped on the Perth bandwagon recently after values have remained stagnant for over a decade. Let’s hope the long-term returns are there for investors.

- Sydney and Adelaideare predicted to be the 2nd & 3rd strongest performers with the potential to provide 10% capital growth.

- Melbourneis expected to bring up the rear with 2-6% growth. We think this is conservative based on the 0.7% growth clocked in November, Melbourne was in a rapid growth phase pre-covid, and counter-intuitively, there is greater upside because of the larger market fall because the market drop was largely artificially imposed. We think Melbourne lockdown #2 is creating bias in many downside predictions. That said, we’re predominantly based in Melbourne and we may have our own unconscious bias. We shall see in 2021!

SQM 2021 predictions

ANZ was the last of the major banks to come off the bench and scrap its forecast for a pandemic-linked 10 per cent drop in house prices for 2020. Better late than never! ANZ now expect strong value growth across the major capital cities as highlighted in our ANZ residential property ladder below:

- Perth 12 per cent.

- Brisbane 9.5 per cent.

- Hobart 9.4 per cent.

- Sydney 8.8 per cent.

- Melbourne prices will lag, with 7.8 per cent growth.

Auction clearances

The national property market continues the rapid rebound. Notable points from the weekend’s auctions include:

- National auction clearance was 74.6% compared to 75.19% last week. This time last year was 64.9%.

- The number of auctions increased in all mainland state capital cities which is highly unusual for this time of year.

- All clearance rates are stronger than this time last year.

- Melbourne recorded the biggest increase in auction volumes, bouncing back with a total of 1,131, increasing from 874 last week, but still below the 1,405 auctions held this time last year.

- Canberra continues to lead the recovery with a 87.23% clearance rate.

- Sydney, Adelaide and Melbourne all remain very strong, clocking in clearance rates around mid-70’s.

If you are not already investing, we can help you get started. It is never too late to make a good decision. Call 1300 828 636 or email us at [email protected] for an appointment now.[/vc_column_text][/vc_column]

[/vc_row]

To find out more about what we can do for you, call 1300 828 636.